Give Through Your IRA – Qualified Charitable Distribution (QCD)

If you are age 70½ or older, you can donate up to $108,000 per year directly from your IRA to our nonprofit without paying income tax on the distribution. This is called a Qualified Charitable Distribution (QCD) — an easy and tax-smart way to support our mission.

When completing your QCD, please instruct your IRA custodian to make the check payable to:

Organization Name: The Cuenca Foundation, Inc.

EIN: 88-3097392

OR

US Bank

The Cuenca Foundation, Inc.

Routing #: 075000022

Acct #: 182897265365

US Bank 425 Pine Street Green Bay, Wisconsin 54301

Thank you for your generous support!

If you have additional questions or require additional assistance contact us at info@cuencafoundation.org

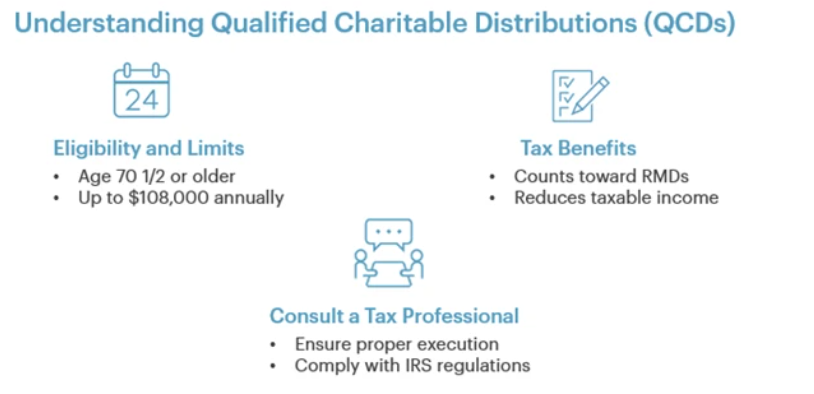

A Qualified Charitable Distribution (QCD) allows individuals age 70½ and older to donate to $108,000 in 2025 (an amount that is adjusted each year for inflation) to public charities direct from an IRA. QCDs can be an effective way to give tovcharity as well as reduce your tax bill, since they are excludable from taxable income. Once you reach the age when required minimum distributions (RMDs) kick in, a QCD can be used to satisfy all or a portion of the RMD that is due from an IRA. There are numerous tax rules to consider before initiating a QCD.

That’s why we recommend discussing this strategy

with your advisor and a tax professional before taking any action.

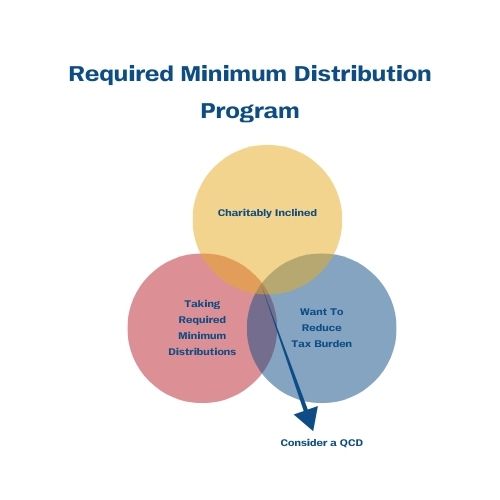

Required Minimum Distributions

If you are 701/2 or older, the IRS requires you to begin to take annual withdrawals called Required Minimum Distributions (RMDs) from your IRA. These are taxed as income and can impact you Medicare premiums, Social Security taxation and more.

A smart way to reduce that tax burden is to make a Qualified Charitable Distribution (QCD), which is a tax free donation made directly from your IRA to a nonprofit like The Cuenca Foundation. It counts as an RMD but it doesn’t count as income.

Qualified Charitable Distribution

A Qualified Charitable Distribution (QCD) is a tax free donation made directly from your IRA to a nonprofit such as The Cuenca Foundation. If you are 70 1/2 or older, a QCD can count toward your Required Minimum Distribution (RMD) without increasing your taxable income.

This strategy can help reduce your adjusted gross income, lower Medicare premiums, and preserve other tax benefits. You can donate up to $108,000 per year, but the transfer must go directly from your IRA to your charity of choice in order to qualify.

Learn More:

How to Use Your RMD to Maximize Charitable Giving – Aspen Times

Charles Schwab RMD Calculator and Guide